Critical assessment of Alternative investment rule – 2015

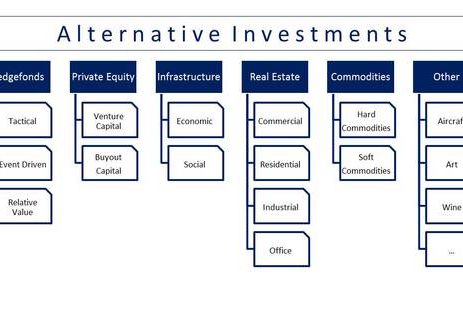

There are a number of grounds upon which this ‘Alternative Investment Rule -2015’ can be critically assessed. ‘Alternative investment’ – it is one of the four broader asset classes where portfolio investors can vest their fund. The alternative investment covers private equity investment, venture capital investment, impact fund investment, real estate, hedge fund investment, gold, minerals, forestry and so many other investments with some common characteristics – low liquidity, ambiguous valuation and higher return. Quite surprisingly, alternative investment rule – 2015 of Bangladesh only deals with venture capital and private equity-related business models. So, this regulation is hardly holistic and integrated. On the counter argument, there had not been any hedge fund, real estate investment trusts, exchange-traded funds in Bangladesh. There are only a few venture capital firms currently operating in Bangladesh; maybe this lacking of organizational set-up can be attributed to the non-presence of other alternative investment vehicles in the Alternative investment rule – 2015.

Payment structures of fund managers have been neglected under the framework. At the initiation days of the venture capital fund formation, it is relatively difficult to collect the capital committed and the NAV of the fund is low. But paperwork and the fund formulation related tricky jobs have to be done in those times. That is why in the developed economy, initially a fund manager is paid up from the committed fund. Later on, the fund managers are paid off from the NAV, since with time the venture capital business expands. But in Bangladesh, a fund manager is expected to get very little for all the hard work during the initiation period as the NAV of the fund is expected to be fairly low initially. Moreover, the regulation has not put enough light on how the benchmark or threshold level is going to be determined and that is another arena of future confusion. There had not been any high-watermark provisions and there had not been any clawback propositions for the fund managers. So, using the loopholes in the fund management system, a fund manager can get the bonus twice on the same performance and there are also possibilities of rewarding the fund manager before the limited partners have been paid up to their vested capital. Share in the bonus needs to be formulated on a deal-by-deal basis and risk-adjusted project specific required rate of return should be the threshold level.

The legal status of the sponsors has not been properly delineated as per the law. They should get be treated as limited partners and their stakes should only be limited to the money vested. There is no specific way mentioned in the regulation about measuring the performance of a fund manager, and there had not been any specific way mentioned in the regulation about the exit way. So, there needs to be a series of amendments to the law regarding exit-avenue, fund manager performance analysis and status of sponsors on a quick basis. Internationally established performance management yardsticks like DPI (distributed-to-paid in capital), RVPI (residual value to paid in capital) and TVPI (total value to paid-in capital) needs to be implemented in order to properly understand the performance of the fund managers.

Date: 15 October 2017

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply