Developing an ‘Enabling regulatory framework’ for Bangladesh based MFS industry

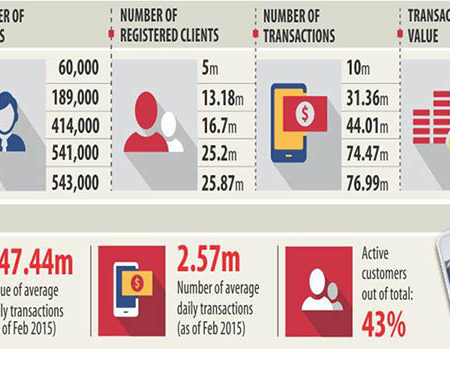

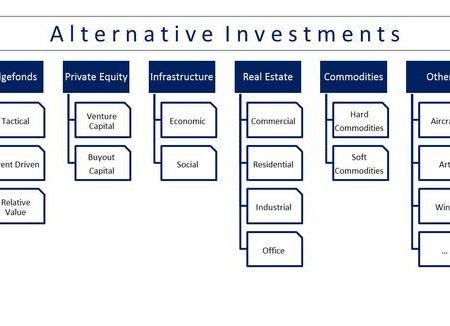

An ‘enabling regulatory framework’ ensures the co-existence of MNOs (Mobile Network Operators) and FIs (Financial Institutions) in the MFS (Mobile Financial Service) value chain. Currently the MFS industry in Bangladesh is bank-driven or bank-led. bKash(a subsidiary of Brac Bank) dominates the MFS competitive space accounting for more than half of the market (58%) followed by DBBL with about one-sixth of subscribers (17%). The remaining eight providers with live services currently account for around a quarter of the total market share (IBBL, UCBL are some other key customers). For developing an ‘enabling regulatory framework’ some regulatory prescriptions are as follows: forming equity partnership with MNO while developing commercial bank-led MFS platforms, forming Joint Venture with MNO for providing MFS, creating Strategic Alliance with MNO under bank-based model, introducing MNO-led payment banks. We expect that Ministry of Finance, Bangladesh Bank (BB), and Bangladesh Telecommunication Regulatory Commission (BTRC) will be the enforcing agency of these policy guidelines.

MFS guideline as prescribed by Bangladesh Bank already accommodates equity partnership up to 30% (under bank-led MFS platform). MNO’s involvement in MFS value chain will reduce transaction cost significantly. Despite this provision, none of the existing MFS providers has equity partnership with MNOs.

Joint Venture of Bank and MNO can also be formed and licensed for using MNO-led transaction platform having interfaced with bank to provide MFS, in which the MNO will be the primary driver of the product or service, typically taking the lead in marketing, branding, and managing the customer relationship. This will provide lower cost solution to provide MFS for greater financial inclusion.

Banks can have strategic alliance with MNO under bank-based model in which the bank will often outsource major activities to MNO (like transmission of e-transaction details and the maintenance of clients’ e-accounts) in order to reduce transaction cost for more financial inclusion.

In addition to forming equity partnership, MNOs can also be licensed to introduce limited scale payment banking facilities (maximum limited deposit size, zero interest on e-wallet, cash in, no cash out and all payment transfer facilities). Leveraging on existing distribution network and USSD infrastructure, the MNO-led payment-banking model will lead to a least cost solution to provide MFS for greater financial inclusion. Airtel- an MNO has already introduced payment banking in India on a pilot basis.

Blog Writer: Hussain Ahmed Enamul Huda

Date: 11 August, 2017

Leave a Reply