A beginner’s guide to lemons problem & information asymmetry

In U.S.A. there is quite a vibrant market for used car. Good quality used cars are known as peaches and bad quality used cars are known as lemons. Obviously, the seller of the used car knows far better about the quality of the car than a potential buyer. Since the buyer of a used car is unsure about the actual quality of a used car, he offers an average quotation for both a good (peach) and bad car (lemon). As the owner of the lemon is quite elated about the price he immediately sells his used car. Since the owner of a peach was not able to fetch a good price he leaves this market. If such scenario continues, one day there will be only bad cars ready to be sold. Any buyer who once got cheated in the used car market will never go back to that market for sure. If such scenario continues, one day the used car market will certainly wane up.

The possible collapse of the used car market can be highly attributable to the information gap between the buyer and seller. When the two parties related with a transaction do not have the same information regarding any material facts that will affect the transaction, we normally refer to such problems as the asymmetric information problem. Since the seller at the used car market knew far more about the quality of the used car than the buyers there always remains some problems regarding asymmetric information.

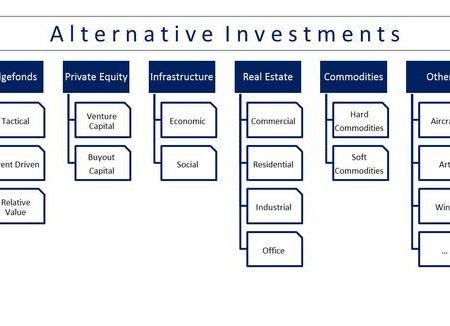

One can easily extend this asymmetric information related issue that occurs in the used car market in the direct financing mode. Since borrowers knows far more about the possible usage of loan there remains asymmetric information problem between borrower and lender. The asymmetric information problem generates two problems in the direct financing mechanism – adverse selection and moral hazard. Since the lender cannot make a difference between a worthwhile lender and a junk lender, he treats both of them equally. Since he cannot really make any real difference between a bad and good borrower he falls in the trap of higher interest rate offered by the bad creditor. Since the bad creditor’s usage of the fund is going to be of a speculative nature he or she can offer a higher rate. Since the bad creditor is going to take unjustifiable level of risk, the good creditor cannot really match up with the bad creditor in terms of offering higher interest since good and legal business opportunity does not fetch extraordinary returns. Lured by the higher rate, the lender avails credit to the risky creditor. Such scenarios are known as adverse selection. Once loan is availed to a risky client he or she gets engaged in such activities, which make the whole repayment process highly uncertain. Such circumstance is known as moral hazard. Due to the adverse selection and moral hazard problem direct financing is not normally the preferred mode of financing. It is financial intermediary that makes the whole process of allocating fund from the surplus unit of the economy to the deficit unit of the economy much easier.

Using the professional expertise and sheer size, business experience a financial intermediary can easily screen out the speculative creditors and wipe them out. Since these institutions are not lured by the higher interest rate the deserving borrowers get the credit. So, the percentage of adverse selection is much lower in indirect financing than the case with direct financing. Moreover by regular monitoring and supervision, the financial intermediary makes sure that the good creditor is really using the fund for the intended purpose, not going for any sort of speculative venture. So, the percentage of moral hazard is much lower in indirect financing than the case with direct financing. Associated services like ATM card, Debit card, Credit card and many more are generally provided to the depositor in the indirect financing mechanism. Moreover, by diversifying the overall asset portfolio, the financial intermediary reduces the loss in case of an industry wise systematic slump. Economies of scale, in reducing the transaction cost are another added advantage of the financial intermediaries. For example, at the personal level it may not be worthwhile to write down an airtight document since it will be used only for one transaction. On the opposite, since the same contract can be used for many a times, there are huge economies of scale for a bank in developing a good loan contract.

Blog Writer: Hussain Ahmed Enamul Huda

Leave a Reply