Digitize G2P and unleash synergies

Digitizing government payments to persons (G2P) serves as an enabler for financial inclusion. Digitization cuts leakages and transaction costs for government, ensures women’s economic participation and paves the way for women empowerment. It brings transparency into government welfare programs.

In 2003, the government of Brazil initiated a massive reform program named Bolsa Familia Program (BFP) in its welfare payments system (replacing all the cash based transfer programs by electronic benefit card). BFP saved the government 31% in transaction costs in running the welfare program. This digitization endeavor of G2P transactions has eventually contributed to 20-25% decrease in inequality and 16% decrease in extreme poverty in Brazil. BFP has also churned synergies by promoting education, public health and economic mobility. As BFP prioritizes making payments to the female head of households (90% of the beneficiaries are women), this digitization venture improved female economic agency and autonomy. Digitization of government payments (G2P) has saved South Africa government 54% in transaction costs in running their state welfare program. Digitization of G2P (government payments to suppliers and individuals for payrolls, pensions, and social benefits) has helped Mexican government save $17 billion per year that represents 3.3% of the state-driven welfare budget.

A major inhibitor to the success of a digitized G2P program is the lack of an existing distribution network that reaches the target recipient base. Colombia incurred much greater cost when digitizing its conditional cash transfer (CCT) programs compared to Brazil, Mexico and South Africa, largely due to its initial attempt to build a distribution network from scratch. So, success of digitized G2P program largely depends on government’s ability to leverage on the existing distribution network of bank-led or MNO-led MFS platform.

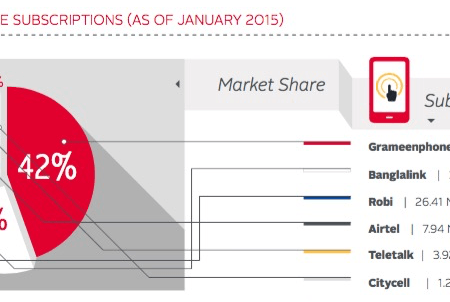

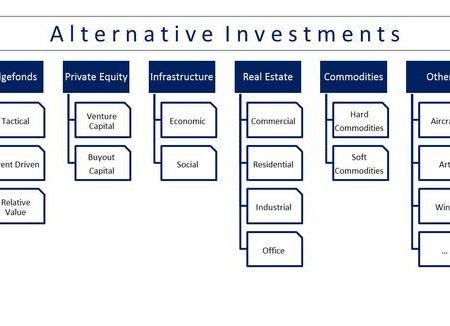

There is strong justification for the digitization of G2P payment (social safety net, salaries, pension and gratuities) in Bangladesh [one major recommendation prescribed under NSSS – National Social Security Strategy]. Currently, 145 social security programmes are administered by 23 Ministries/Divisions in Bangladesh. Estimated leakage is around $100 million for top 14 social safety net programs (most of these programs use cash-based payments). Corruption and inefficiency in cash-based systems could be better addressed if the payments are digitized. Moreover, digitization of G2P payment disbursement would save an estimated $146 million annually which can be translated to 44% of the total operating cost. Although government policy is in place for digitizing the overall G2P (salaries) process, but currently this solution is limited to only senior-level executives in government offices. By building up a central database (containing key information of all government employees), direct fund transfer of salaries can be made possible. Proper implementation of the proposed multi-tiered national pension system (Tier 1: The Citizens’ Pension, Tier 2: National Social Insurance Scheme, Tier 3: Private Voluntary Pensions) would depend of government’s ability to digitize G2P transactions through leveraging on the existing distribution network of bank-led or MNO-led MFS platforms.

Reference:

BTC (2016) Building digital Bangladesh: The way forward for Digitizing Payments.

BTC (2016) Accelerators to an inclusive digital payments ecosystem.

GoB (2015) National Social Security Strategy (NSSS) of Bangladesh.

Leave a Reply